kentucky sales tax on-farm vehicles

Interactive Tax Map Unlimited Use. Printable Kentucky Farm Certificate of Exemption Form 51A158 for making sales tax free purchases in Kentucky.

10 Farm Tractor Salvage Yards In Kentucky 2021 Farming Base

For vehicles that are being rented or leased see see taxation of leases and rentals.

. You can easily access coupons about Kentucky Sales Tax On Farm Vehicles Silvana Eckert by clicking on the most relevant deal below. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all. Ad Lookup Sales Tax Rates For Free. For example an item that costs 100 will have a tax of 6 for a total of 106 100 times 06 equals.

For example Kentucky exempts from tax feed farm. Kentucky Sales Tax Rate - 2022. For Kentucky it will always be at 6.

650 Definitions for KRS 186650 to. Kentucky Sales Tax information registration support. To calculate the sales tax on your vehicle find.

Kentucky Sales Tax Guide - Chamber Of. Kentucky Department of Revenue Division of Sales and Use Tax PO Box 181 Station 67 Frankfort KY 40602-0181. State Tax Rates.

Exempt from weight distance tax in Kentucky KYU. Printable Kentucky Farm Certificate of Exemption Form 51A158 for making sales tax free purchases in Kentucky. In addition to taxes car.

Motor Vehicle Usage Tax. Kentucky sales tax law includes numerous general agricultural exemptions but many do not apply to the equine industry. WebThe Kentucky sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the KY state tax.

How to Calculate Kentucky Sales Tax on a Car. KRS 138477 imposes a new excise tax on electric vehicle power distributed by an electric power dealer to charge electric vehicles in the state at the rate of three cents 003 per kilowatt. Ad New State Sales Tax Registration.

Sales Tax On Cars And Vehicles In Kentucky. SALES AND USE TAX The sales and use tax was first levied in its current form in 1960. Your single source of information about state and federal laws and regulations governing farm vehicles traveling on the states roads.

To the Kentucky sales tax will vary by state. You can easily access coupons about Kentucky Sales Tax On Farm Vehicles Aurora Perreault by clicking on the most relevant deal below. To calculate Kentuckys sales and use tax multiply the purchase price by 6 percent 006.

Tangible Personal Property State Tangible Personal Property Taxes

Form 51a270 Fillable Certificate Of Sales Tax Paid On The Purchase Of A Motor Vehicle

Tangible Personal Property State Tangible Personal Property Taxes

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky S Car Tax How Fair Is It Whas11 Com

Ag Prepares For Electric Powered Future

Sales Tax Laws By State Ultimate Guide For Business Owners

Free Farm Tractor Bill Of Sale Form Pdf Word Eforms

Ag Prepares For Electric Powered Future

Filing A Kentucky State Tax Return Credit Karma

Farmers Encouraged To Apply For New Agricultural Exemption Number

Publication 225 2021 Farmer S Tax Guide Internal Revenue Service

Small Prairie Plantings Bring Big Rewards In Midwest Farm Fields Wisconsin Public Radio

Farm Or Ranch Property Insurance State Farm

Kentucky Sales Tax Exemption For Manufacturers Agile Consulting

Ford Brothers Annual Farm Machinery Consignment Auction

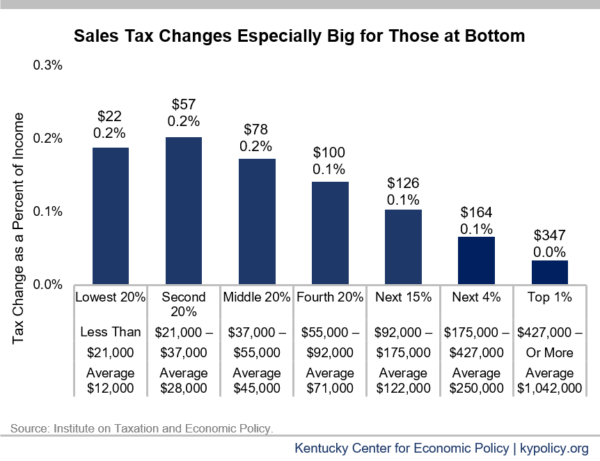

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Update On Agriculture Exemption Number For Sales Tax Exemption On Farm Purchases Agricultural Economics

Ford Brothers Fall Farm Machinery Equipment Vehicles Online Consignment Auction